|

|

|

|

|

|

|

EXTERNAL ASSET MANAGERSAnlly Asset Management cooperates with a number of top private banks. As an external asset manager, Anlly manages wealth and formulates diversified asset allocation plans for UHNW individuals and inter-generational wealthy families through various types of financial investment products. External Asset Management (EAM) can act as third-party platforms and as professional investment teams for high-net-worth clients, saving them a lot of time and energy to deal with financial institutions, and also liberating them from the troubles of wealth management. Anlly assists clients in opening accounts with private banks and then deposit assets into the accounts. The clients grant EAM authorization and power of attorney as a third party, allowing Anlly to manage the investment portfolio and perform asset allocation on their behalf. |

|

|

|

|

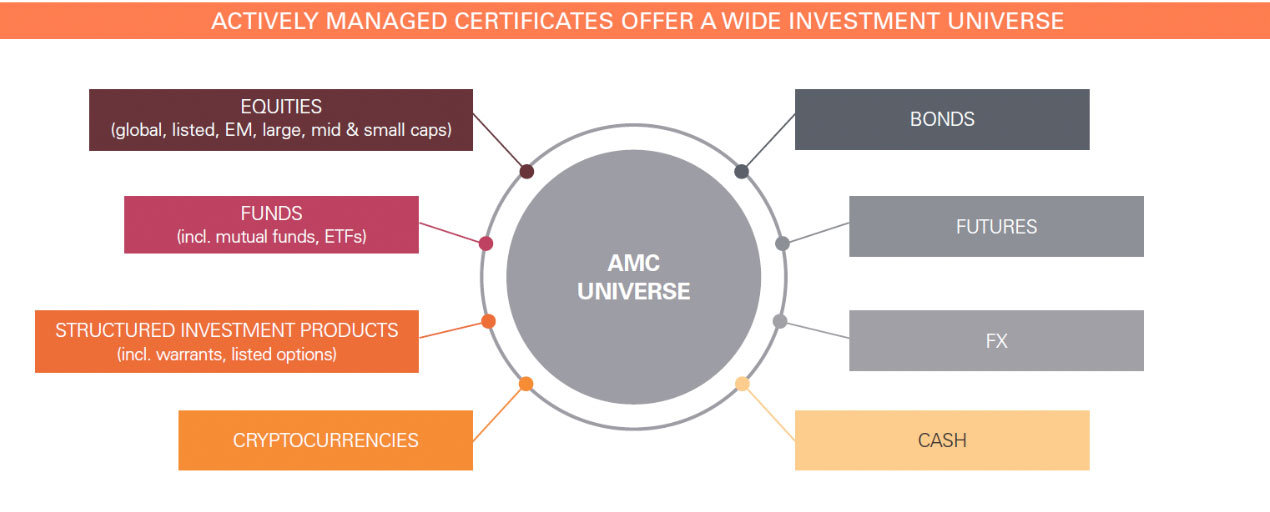

ACTIVELY MANAGED CERTIFICATESActively Managed Certificates (AMCs) are an innovative portfolio management solution (Index Sponsors) – allowing us to implement a proprietary technical or fundamental investment strategy with greater flexibility, operational efficiency and transparency. The solution is offered at a fixed, transparent administration fee and without any additional set-up cost. AMCs have a bankable ISIN and can be bought from virtually any custodian bank. The secondary market ensures that there is ongoing liquidity during market hours. Index Sponsors use Leonteq’s proprietary platform to create and manage the Index that provides access to almost any liquid asset classes on a discretionary basis. |

|

|

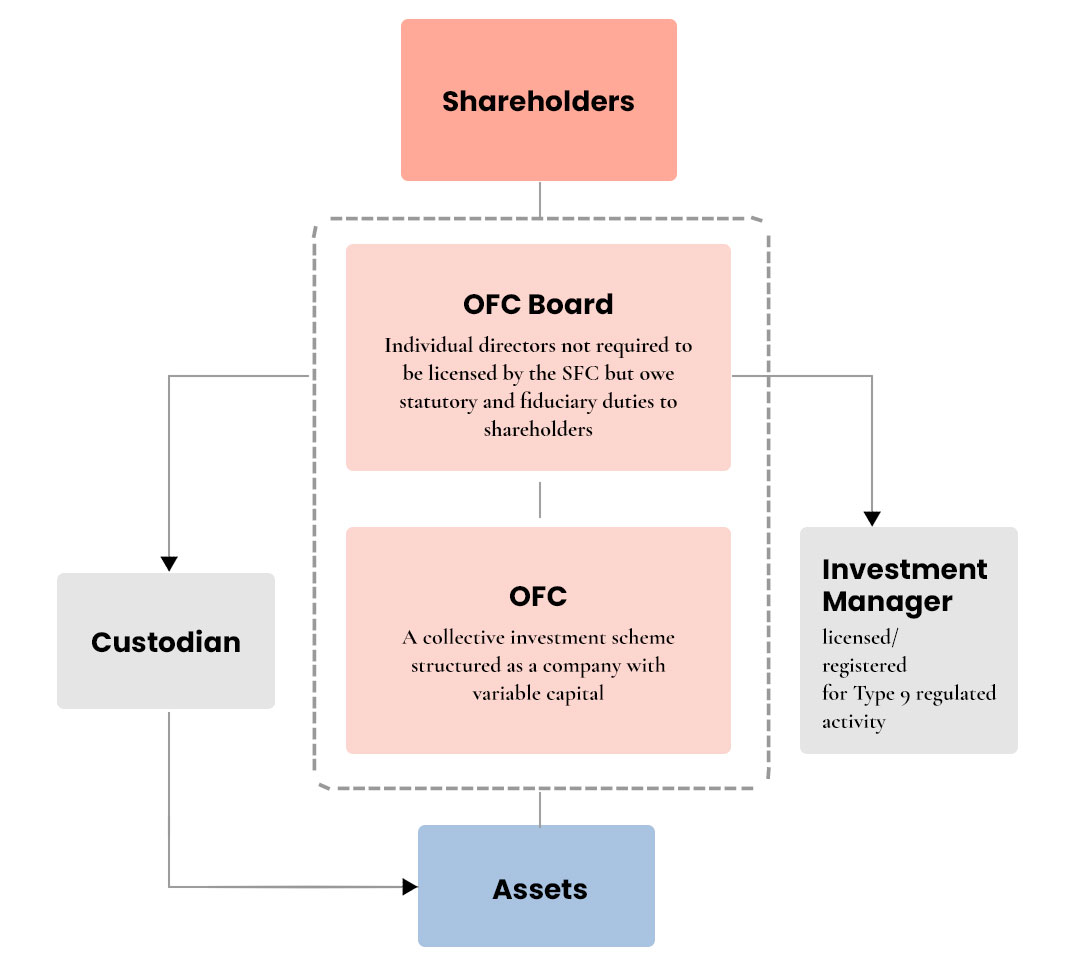

OPEN-ENDED FUNDOpen-ended fund Company OFC is an investment fund established in corporate form with limited liability and variable share capital in Hong Kong.

As the primary regulator, the SFC processes registrations and oversees OFCs. The Companies Registry (CR) is responsible for the incorporation and corporate filings of OFCs.

OFCs, whether publicly or privately offered, are required to be registered by the SFC. Same as other publicly offered funds, publicly offered OFCs are also required to obtain prior authorization from the SFC, unless an exemption applies. |

|

|

|

|

WEALTH LEGACYWe offer a comprehensive range of services, including wills, trusts, foundations, family offices, business succession planning, tax advisory, philanthropy and more. Our team of experienced professionals is dedicated to helping you preserve and grow your wealth for generations to come. Whether you are looking for a simple will or a complex trust structure, we can tailor a solution that meets your specific needs and goals. Contact us today to schedule a free consultation and find out how we can help you create a lasting legacy for your loved ones. |

|

|

New Capital Investment Entrant Scheme (CIES)The new CIES will accept applications from eligible persons aged 18 or above (including foreign nationals, Chinese nationals who have obtained permanent resident status in a foreign country, Macao Special Administrative Region residents and Chinese residents of Taiwan). An applicant must demonstrate that he/she has net assets of not less than HK$30 million to which he/she is absolutely beneficially entitled throughout the two years preceding the application. An applicant must make an investment of a minimum of HK$30 million in the permissible investment assets, including investing a minimum of HK$27 million in the permissible financial assets and non-residential real estate (at Annex), and placing HK$3 million into a new CIES Investment Portfolio. The Portfolio will be set up and managed by the Hong Kong Investment Corporation Limited to make investments in companies/projects with a Hong Kong nexus, with a view to supporting the development of innovation and technology industries and other strategic industries that are beneficial to the long-term development of Hong Kong's economy. |

|